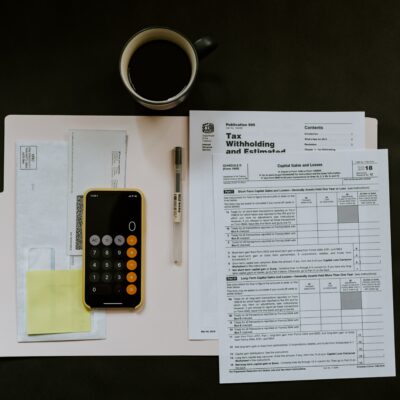

Tax season can be a stressful time for many business owners, freelancers, and individuals alike. Between gathering receipts, organizing expenses, and ensuring everything is in order, the pressure to file accurately and on time can be overwhelming, especially when you’re on a tight deadline. Fortunately, with the right tools, last-minute tax prep doesn’t have to be a nightmare. QuickBooks is here to help, making the process smoother, faster, and more efficient.

Whether you’re scrambling to get everything together or simply want to make sure your tax filing is as streamlined as possible, QuickBooks can be a lifesaver. In this post, we’ll explore how QuickBooks helps with last-minute tax prep, expense tracking, and overall organization—ensuring that you can meet your deadlines without stress. Plus, we’ll show you how you can save 30% for the first six months and get 30 days of QuickBooks Live Expert Assistance when you sign up with our affiliate link.

Last-Minute Tax Prep Made Easy with QuickBooks

Tax prep often feels like a race against the clock. If you’ve left your taxes to the last minute, there’s no need to panic. QuickBooks offers a variety of features that simplify the tax process, whether you’re filing for your personal taxes or managing taxes for your business. Here’s how it can help:

1. Automatic Tax Calculations

One of the most time-consuming aspects of preparing taxes is calculating how much you owe or are owed. QuickBooks handles all the math for you. With automatic tax calculations, QuickBooks ensures that you’re calculating your taxes correctly, factoring in any deductions, credits, or exemptions. The system updates tax rates automatically so you never have to worry about keeping up with the latest tax law changes.

This feature alone can save you hours of work and potentially prevent costly mistakes, which is a huge advantage when you’re working under tight deadlines.

2. Easy Tax Reporting

QuickBooks has a number of reports specifically designed for tax season, including Profit & Loss, Balance Sheet, and Tax Summary reports. These reports help you quickly identify your income, expenses, and overall financial picture—crucial information when filing your taxes. With just a few clicks, you can pull these reports and have everything you need to file accurately.

If you’re working with an accountant, QuickBooks makes it easy to share reports and documents. You can grant them access to your account or export the reports for quick sharing, saving you the hassle of sorting through piles of paperwork.

3. Track Deductions Automatically

For business owners, freelancers, and self-employed individuals, maximizing deductions is one of the keys to lowering your tax liability. QuickBooks makes it easy to track deductions automatically. Whether it’s mileage, office expenses, or travel costs, QuickBooks organizes your deductions as you go, so you don’t have to dig through your bank statements come tax time.

With QuickBooks, you can easily categorize and tag your expenses, making it easy to track what’s deductible. This feature ensures that you don’t miss any potential tax-saving opportunities and can save valuable time when preparing your tax return.

Effortless Expense Tracking

Tracking expenses is a critical part of staying organized during tax season. However, when you’re busy and pressed for time, keeping up with every receipt and purchase can be a challenge. QuickBooks makes it easy to track and manage your expenses throughout the year, which is especially helpful when tax time arrives.

1. Receipt Scanning and Expense Entry

Gone are the days of collecting stacks of paper receipts and manually entering them into your records. With QuickBooks, you can simply snap a photo of your receipts with your phone, and the system will automatically input the relevant details into your expense tracker. This feature saves you time and reduces the chances of losing important receipts in the chaos of tax season.

Additionally, QuickBooks allows you to categorize your expenses as they’re entered, so you can track everything from office supplies to client meals, ensuring everything is organized come tax time.

2. Bank Account and Credit Card Syncing

For a more seamless expense-tracking experience, QuickBooks automatically syncs with your bank account and credit cards. This means that every transaction made on your business account is recorded in QuickBooks, and you can easily categorize it as either a business or personal expense. This eliminates the need for manual data entry and provides you with a more accurate picture of your finances.

Whether you’ve made a business purchase using your credit card or paid for something out of your personal account, QuickBooks ensures that everything is recorded, leaving no expenses unaccounted for.

3. Real-Time Expense Tracking

QuickBooks keeps track of your expenses in real-time. This means that you can monitor your spending throughout the year, allowing you to adjust your budgeting and make better financial decisions. When it’s time to file your taxes, you’ll have an up-to-date, accurate record of every expense, so you won’t have to worry about missing anything.

Organizing Your Finances for a Stress-Free Tax Season

The key to a smooth tax season is organization. With QuickBooks, you can stay on top of your finances all year round, making tax time less stressful and more efficient. Here’s how it helps you stay organized:

1. Organize All Your Documents in One Place

QuickBooks acts as a central hub for all your financial documents. You can upload and store your receipts, invoices, and other important files directly into the system. Everything is neatly organized and easy to access when you need it. No more searching through piles of papers or digging through email attachments—everything you need is just a few clicks away.

2. Set Reminders and Deadlines

QuickBooks allows you to set reminders for important deadlines. Whether it’s a quarterly tax payment or a bill that needs to be paid, QuickBooks helps you stay on top of all your financial tasks. Setting reminders ensures that you won’t miss crucial deadlines, keeping you ahead of the game and reducing the stress of last-minute scrambling.

3. Simplified Invoicing and Payments

QuickBooks also helps you stay organized by offering easy-to-use invoicing and payment tracking features. By sending invoices directly through the platform, you can track payments and automatically update your accounts, reducing the chances of unpaid bills slipping through the cracks. Plus, clients can pay directly through the invoice, streamlining your cash flow.

Special Offer: 30% Off for Six Months + 30 Days of QuickBooks Live Expert Assistance

Now, if you’re ready to simplify your tax prep and expense tracking, there’s never been a better time to sign up for QuickBooks. When you sign up through our affiliate link, you’ll receive 30% off for the first six months and 30 days of QuickBooks Live Expert Assistance.

This special offer gives you access to QuickBooks’ powerful features while saving you money. Plus, the 30 days of QuickBooks Live Expert Assistance will provide you with personalized guidance from a QuickBooks expert, ensuring that you get the most out of the software and are fully prepared for tax season.

Final Thoughts

With QuickBooks, you can tackle last-minute tax prep, keep your expenses organized, and ensure that everything is in order, no matter how tight your deadline may be. By simplifying the process, QuickBooks takes the stress out of tax season, so you can focus on what matters most. Whether you’re managing your personal taxes or handling business finances, QuickBooks offers the tools you need to stay on top of your financials and file with confidence.

Don’t let the pressure of tax season get the best of you. Sign up today through our affiliate link and take advantage of the 30% discount for six months and the 30 days of QuickBooks Live Expert Assistance. It’s time to make tax prep and expense tracking easier than ever before!